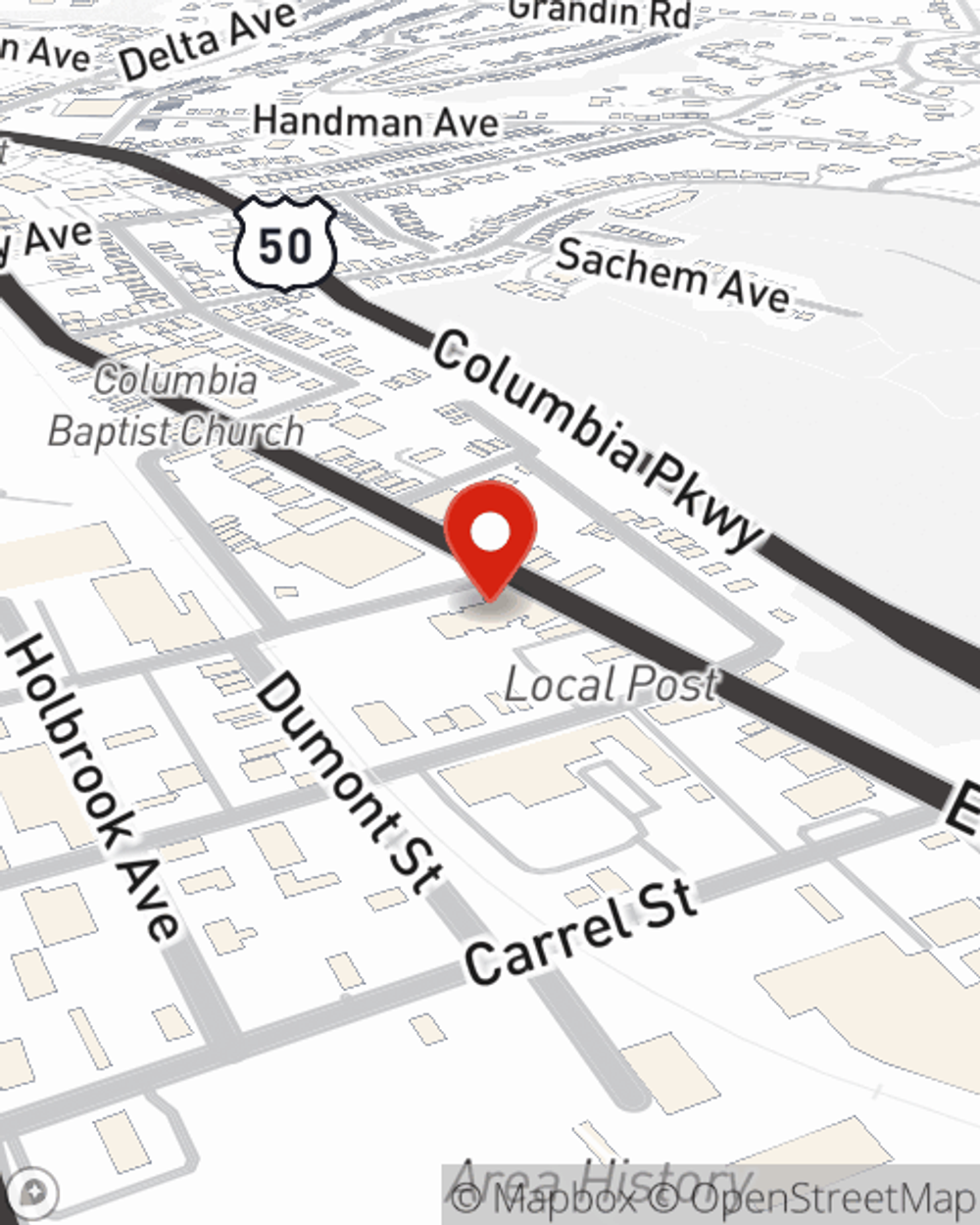

Business Insurance in and around Cincinnati

One of Cincinnati’s top choices for small business insurance.

No funny business here

Your Search For Outstanding Small Business Insurance Ends Now.

When experiencing the highs and lows of small business ownership, let State Farm be there for you and help provide excellent insurance for your business. Your policy can include options such as worker's compensation for your employees, business continuity plans, and a surety or fidelity bond.

One of Cincinnati’s top choices for small business insurance.

No funny business here

Cover Your Business Assets

Your company is special. It's where you earn a living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a facility or a store. Your business is your life's work. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers a variety of occupations like a drywall installer. State Farm agent Kim Noe is ready to help review coverages that fit your business needs. Whether you are an electrician, a drywall installer or an acupuncturist, or your business is a candy store, a travel agency or a shoe repair shop. Whatever your do, your State Farm agent can help because our agents are business owners too! Kim Noe understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Ready to review the business insurance options that may be right for you? Call or email agent Kim Noe's office to get started!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Kim Noe

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.